QIMA 2020 Q1 Barometer

2019 in Review – China Sourcing Volumes Drop for First Time Ever, While Quality and Sourcing Ethics Suffer in Emerging Regions

While the promise of a US-China trade deal may have brought some welcome optimism to the holiday season, the changes wrought on global trade by the trade wars of 2019 will linger. Geographical diversification of sourcing, already a fact of life before the tariff stand-off, has been propelled to new heights by the trade dispute. In 2020, global supply chains will continue the move towards a more regionalized paradigm, with pockets of production defined by national and political interests.

As businesses try to navigate this changing supply chain landscape, new manufacturing regions are stepping up to seize the opportunities. However, a look at QIMA’s 2019 data shows that when brands forge ahead to new sourcing frontiers, it often comes at the expense of consumer safety and supply chain ethics.

Who’s Winning the US-China Trade War? Neither US, nor China

QIMA’s data on production inspection and supplier audit demand in 2019 confirms the popular conclusion that neither the United States nor China are among the winners of the US-China trade war. While many US buyers moved their sourcing away from China (inspection demand -14% YoY in 2019 vs. 2018), they were not in a hurry to bring the manufacturing back home, instead dividing the diverted business between near-shoring regions and China’s neighbors in Asia. In 2019, demand for inspections and audits from US brands expanded by +9.7% YoY in Southeast Asia (with Vietnam, Taiwan and Myanmar among the top destinations) and by +37% YoY in South Asia, with Bangladesh enjoying renewed popularity.

Meanwhile China as a manufacturing hub saw overall inspections and audits volumes decrease (-3.4% YoY), with the growing demand from other emerging regions not fully compensating for the escape of North American, Australian and, to a lesser extent, European customers.

2019: the Year of Near-Shoring

While massive re-shoring of manufacturing remains unlikely, both tariffs and non-tariff factors (increasing output costs, the search for adequate manufacturing capacities, and the ever-growing need for supply chain flexibility, to name a few) drove buyers in the USA and the EU to move significant portions of their sourcing closer to home during 2019. For American businesses, the near-shoring trend translated to rapid expansion in Latin and South America: inspection and audit demand from US buyers in the region more than doubled in 2019 vs. 2018, with Mexico, Peru, Guatemala and Haiti the most popular sourcing destinations. Meanwhile, EU brands favored North Africa and the Middle East, with inspection and audit volumes tripling in 2019 YoY compared to 2018. In addition to familiar sourcing grounds like Turkey, Morocco or Tunisia, Egypt also saw double-digit growth in inspection demand.

Sustainability Progress Stagnates in Global Supply Chains

On-site audits by QIMA show that throughout 2019, ethical and environmental progress in global supply has stagnated as businesses consistently prioritized operational concerns over sustainability. Over 18% of factories audited in 2019 had critical ethical violations, of which almost 40% were related to working hours and wage non-compliances. Violations related to child labor were recorded in 3% of factories, a slight improvement on the 2018 figure.

Meanwhile, the share of factories ranked “Amber” or “in need of improvement” grew to a record high in 2019 (44.5% vs. 37% in 2018). This coincided with a drop in the percentage of compliant “Green” factories (down by 4 points), signaling that buyers were more likely to settle for “good enough” ethical performance, instead of driving continuous improvement in their supply chains and securing progress through regular follow-up.

In Emerging Regions, Growth Goes Hand-in-Hand with Poor Sourcing Ethics

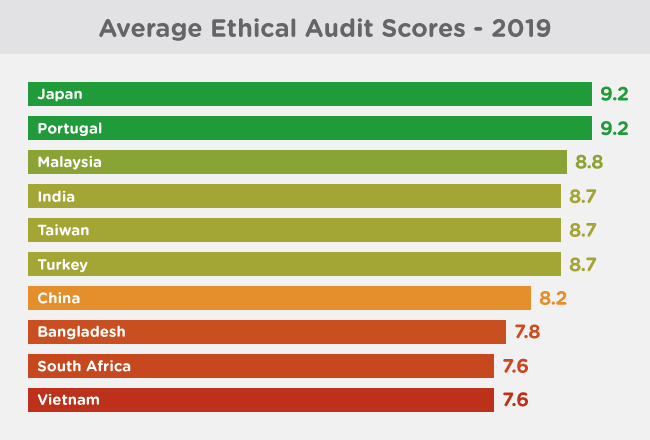

Ethical performance of specific regions in 2019 mirrored the shifting sourcing geographies: social compliance was more likely to suffer in regions that experienced an influx of buyers. For instance, in Southeast Asia, where countries like Malaysia, Myanmar and the Philippines saw double digit growth from Western buyers in 2019, average ethical scores dropped -4.6% compared to the previous year. In South Asia, the same was true for Bangladesh: a noticeable (-7.1% YoY) drop in ethical scores during a year of increased demand.

Meanwhile, ethical compliance in Chinese factories improved in 2019, with scores recorded by QIMA auditors rising by +5% compared to 2018 averages. The shifting of price-sensitive sourcing to other countries may well be a factor in this: historical QIMA data shows that low-cost and manual-heavy sectors such as Textiles and Apparel are much more prone to ethical violations, compared to industries with higher cost of outputs, better training and more automation.

Sourcing Region Maturity Remains a Strong Predictor of Quality

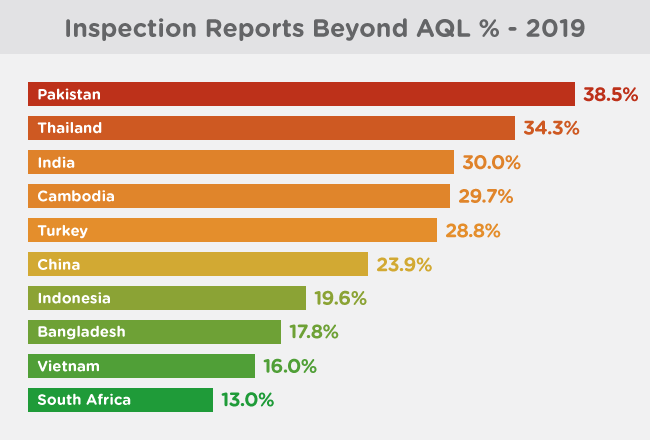

QIMA data about product quality gathered during in-factory inspections shows that 2019 was a mixed bag, with mature markets consistently better able to deliver on spec than emerging sourcing regions.

For instance, China continued its long-term trend for incremental improvement in manufacturing quality: 24% of products inspected in Chinese factories were found outside specifications in 2019, compared to 27% in 2018. Manufacturers in South Asia, despite the region’s reputation for being a quality hotspot, also succeeded at keeping the percentage of defective products under 25% (compared to over 27% in 2018).

Other regions struggled to maintain consistent quality at increased production levels. Among China’s neighbors, the rate of defective products grew by +13% YoY in Indonesia and +48% YoY in Thailand; while suppliers in North Africa and the Middle East had trouble coping with increased sourcing volumes, as the percentage of products outside of acceptable quality limits climbed by +21% YoY in 2019 vs. 2018 (+31% for Textiles and Apparel).

As 2020 opens with an array of geopolitical risks ranging from the tensions with Iran, to the looming EU trade war, to the protracted Brexit process, 2019’s global trade uncertainty looks unlikely to be eased any time soon. In these volatile conditions, having the right tools and programs to increase flexibility, reactivity and collaboration in one’s supply chain will become even more of a strategic competitive advantage.

QIMA Barometer Key KPIs

Press Contact

Email: press@qima.com