QIMA 2021 Q2 Barometer

QIMA Q2 2021 Barometer: As Businesses Look To Leave ‘Crisis Mode’ Behind, Diversification Continues While Ethical Compliance and Quality Take a Hit

QIMA inspection, audit and survey data collected in the first quarter of 2021 highlights the desire to diversify global supply chains. As businesses hope to leave the “crisis mode” of the pandemic behind them, China sourcing is bouncing back strongly but is yet to return to pre-Covid levels, while alternative sourcing regions such as Vietnam, India and Turkey are experiencing sustained levels of growth. But as global sourcing seeks a quick recovery, compliance violations are on the rise, with brands turning to digital technology solutions to better manage ethical risks and solve ongoing supplier communication and product quality challenges.

This barometer report, informed by internal QIMA data and the findings of a survey of 700+ businesses with international supply chains, looks at the supply chain highlights of Q1 2021 and the emerging trends that may influence the global sourcing landscape in the months to come.

Vietnam enjoys sustained popularity, dominating among China’s regional competition in 2020 and 2021

A traditional first choice for buyers diversifying away from China, Vietnam saw its popularity among Western buyers grow by leaps and bounds over the past few years – a trend that has remained in effect so far in 2021. QIMA data shows +16% YoY expansion in demand for inspections and audits in Vietnam in Q1 2021, which represents a third consecutive quarter of growth that had initially begun as a post-lockdown rebound in mid-2020.

It is worth noting that this growth is more than just a return to pre-pandemic levels, as Q1 2021 inspection demand has, on average, doubled compared to Q1 2019.

The inspection surge in Vietnam is in line with the findings of the QIMA global sourcing survey, where 43% of US-based respondents cited Vietnam among their TOP3 buying geographies as of early 2021 (twice the percentage observed in 2019).

Furthermore, the appetite for Vietnam sourcing is far from satisfied and is poised to redefine the sourcing landscape in 2021: around one-third of buyers globally and 38% of US-based buyers name it among countries from where they plan to buy more in 2021.

That said, Vietnam is not the only country in the region to benefit from expanded business volumes, as QIMA data on inspection and audits demand in Southeast Asia shows double-digit growth across the board, fueled by the renewed interest from American and European brands alike.

After a tough 2020, India, now poised for a comeback, is being eyed by multiple sectors for sourcing

Following a year battered by pandemic-related lockdowns and massive order cancellations due to collapsed demand in the West, India has returned to the forefront as a sourcing destination of choice for many buyers. Among the respondents of the QIMA survey, 26% named India among their TOP3 sourcing geographies. Notably, despite being traditionally viewed as a Textile hub, India as a buying market was regarded just as highly for Promotional Products, Footwear, and Eyewear, Jewelry and Accessories (ranked as a TOP3 sourcing choice by over one-third respondents in all those sectors).

Internal QIMA data on audit and inspection demand confirms the increased interest in India sourcing in Q1, when demand for inspections and audits spiked +72% YoY compared to 2020 where India faced a complete manufacturing shutdown (+94% compared to Q1 2019). This growth far outpaces the Q1 YoY growth rate of the South Asia region as a whole (+28% YoY in Q1 2021) driven, among other things, by an influx of US-based buyers: inspection demand from them has been on the rise for a consecutive six months.

However, this rebound for the moment appears dependent on how effectively India manages its ongoing battle against COVID-19 as case numbers dramatically rise in April and renewed pandemic-control measures are put in place.

China’s rebound remains strong, but struggles to reach pre-pandemic levels

Even though China continues to emerge strong in the post-pandemic period, the long-term diversification trends in global supply chain are continuing to chip away at its dominance – and while the surge in first-quarter China sourcing volumes compared to the previous year is undeniable (inspection demand +55% YoY in Q1 2021 vs. Q1 2020), it does not always translate into growth compared to the pre-pandemic period.

The Textile and Apparel sector is a vivid example of this trend: while textiles inspection demand in China rose +8.3% YoY in Q1 2021, it still represented a -20% drop compared to Q1 2019. By contrast, China’s competitors in textiles and apparel, such as Vietnam, India and Bangladesh, recorded double-digit growth in demand for inspections compared to Q1 2020 as well as Q1 2019, indicating sustained expansion over pre-pandemic levels rather than a simple rebound.

Turkey a favorite for near-shoring as European brands keen to resume buying close to home

Near-shoring suffered a notable setback during 2020, when the pandemic crisis delivered the one-two punch of local lockdowns and collapsing buyer demand to the near-shoring regions of American and European buyers (South and Latin America, and North Africa and the Middle East, respectively). However, as global supply chains are emerging from crisis mode, buying closer to home is coming back onto brands’ and retailers’ agenda.

EU brands in particular are eager to revisit from the familiar buying markets in the Mediterranean, with Turkey, a clear favorite, being named as a priority sourcing choice by almost one-third of EU-based respondents of the QIMA survey. Internal QIMA data for Q1 2021 suggests that European buyers are already putting into motion their plans to revitalize Turkey sourcing, as demand for inspections and audits in Turkey has increased +89% YoY in Q1 2021.

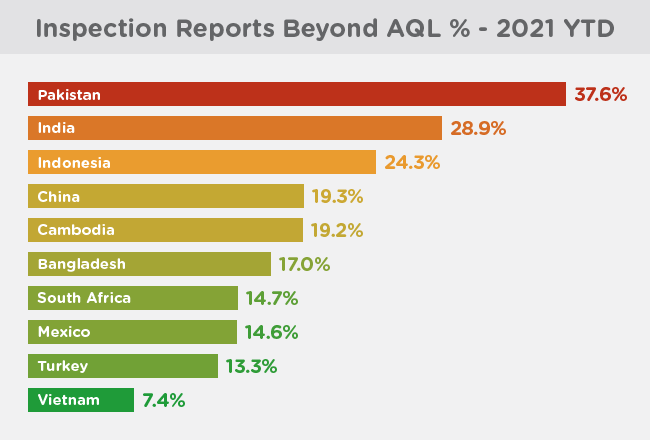

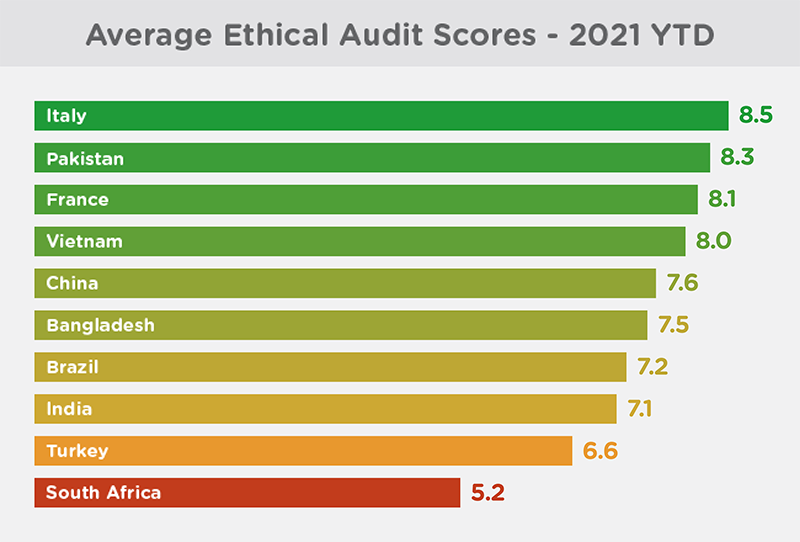

Compliance violations at a three-year high as ethical risks mount

The previous year saw ethical risks mounting in global supply chains in the face of the complex challenges and wide-ranging disruptions, with over one-third of businesses in the QIMA survey reporting that they observed additional ethical issues in their supply chain as a result of the pandemic. The latest field data collected by QIMA ethical auditors suggests that this concerning trend continues in Q1 2021: the percentage of factories assigned a failing grade due to critical non-compliance (“Red”) climbed to 27%, a three-year high.

Perhaps unsurprisingly, compliance was worst in the area of Health & Safety and Hygiene, where 15% of audited factories were found to have critical violations.

Digital transformation of sourcing key for visibility, product quality and supplier communication

Alongside responsible sourcing and sustainability, the pandemic-related disruptions of 2020 had a tangible impact on such aspects of sourcing as supplier communication (reported as an issue of note by 59% of respondents in the QIMA survey) and product quality (41%). Notably, companies with a low degree of supply chain digitization were found to be twice as likely to have serious issues in both these areas.

Given the profound impact technology can make in the supply chain, it comes as no surprise that digital transformation remains top of mind for businesses. Around two-thirds of respondents in the QIMA survey reported that they implemented new technological solutions in response to the COVID-19 crisis during 2020 – and as many are continuing to further digitize their supply chain in 2021. Adoption of technological solutions in the supply chain will also contribute to improving supply chain visibility, which is instrumental for addressing both ethical and operational problems in supply chains.

QIMA Barometer Key KPIs

Press Contact

Email: press@qima.com